Table of Contents

ToggleWage Works Health Equity

Introduction

Companies are realizing more and more how important it is to assist their workers’ financial well-being in today’s fast-paced environment. A crucial component of this assistance is providing perks such as Wage Works Health Equity initiatives. The purpose of these programs is to provide workers with the necessary skills and resources to efficiently manage their healthcare costs. We’ll examine the idea of wage works health equity and its advantages for both employers and workers in this post.

Understanding Wage Works Health Equity

Wage Works Health Equity is the name given to a group of financial instruments and services intended to assist workers in better understanding and controlling their medical expenses. These programs often include Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and other wellness benefits. The core idea is to provide employees with pre-tax dollars to cover eligible healthcare expenses, thereby reducing their financial burden and promoting overall well-being.

Key Features of Wage Works Health Equity Programs

- Health Savings Accounts (HSAs): Allow employees to contribute pre-tax money to cover qualified medical expenses.

- Tax advantages for both employers and employees.

- Funds roll over year-to-year, promoting long-term savings.

- Flexible Spending Accounts (FSAs): Similar to HSAs but with certain differences in contribution limits and rollover rules.

- Cover various healthcare expenses such as copayments, deductibles, and prescription medications.

- Use-it-or-lose-it rule applies, encouraging timely utilization of funds.

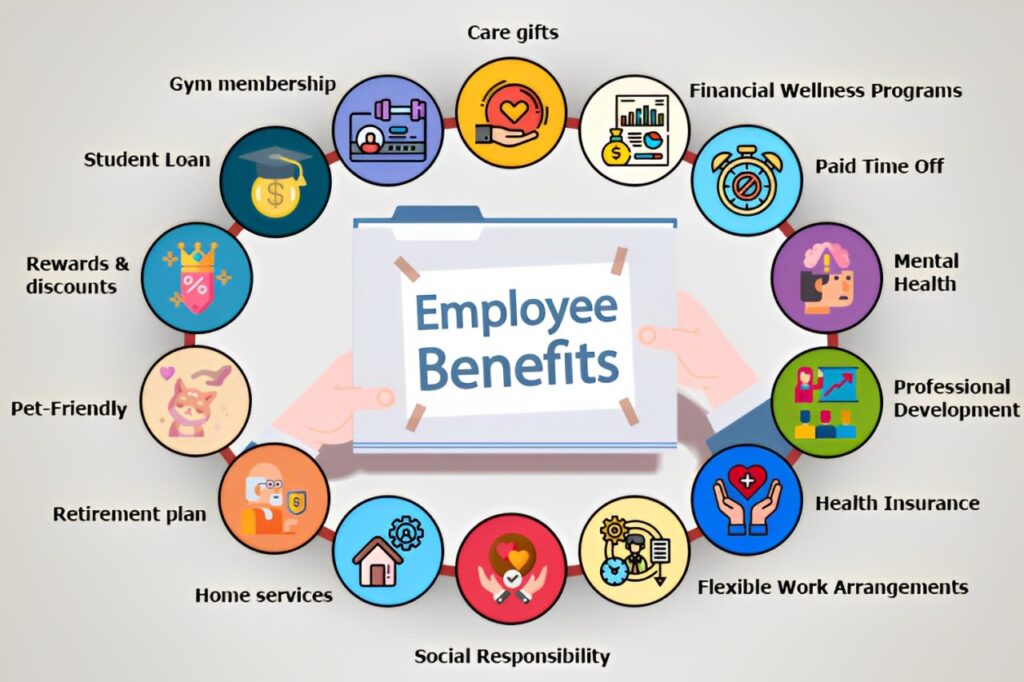

- Wellness Programs: Often included into Health Equity programs to encourage preventative care and good living choices.

- Incentives for participation, such as gym memberships reimbursement or wellness education.

Benefits for Employees and Employers

Employee Benefits

- Financial Flexibility: Wage Works Health Equity programs enable employees to budget for healthcare expenses efficiently.

- Tax Savings: Contributions to HSAs and FSAs are tax-deductible, reducing employees’ taxable income.

- Comprehensive Coverage: From routine medical visits to unexpected emergencies, these programs cover a wide range of expenses.

- Long-term Savings: HSAs, in particular, allow for savings accumulation over time, serving as a valuable financial asset.

Employer Benefits

- Attract and Retain Talent: Offering robust health equity benefits can be a competitive advantage in recruiting and retaining top talent.

- Tax Advantages: Employers also enjoy tax benefits by contributing to employees’ HSAs or offering FSA options.

- Improved Productivity: Productivity rises with the attention and engagement of financially secure workers at work.

- Healthier Workforce: Wellness initiatives integrated with health equity programs promote a healthier overall workforce, reducing absenteeism and healthcare costs.

FAQs about wage work health equity

Q1. Are there any limitations or exclusions with Wage Works Health Equity programs?

While Wage Works Health Equity programs offer comprehensive coverage, certain limitations and exclusions may apply. Common exclusions include cosmetic procedures, over-the-counter medications without a prescription, and non-medical services like spa treatments or gym memberships without a medical necessity.

Q2. How do employees enroll in Wage Works Health Equity programs?

Typically, workers join in Wage Works Health Equity programs during the time that their employer designates as open enrollment. As necessary, they may name beneficiaries and choose the desired benefits and contribution amounts. For qualifying life events like marriage, childbirth or adoption, or a change in work status, some businesses additionally provide mid-year enrollment choices.

Q3. Can employees change their contributions to Wage Works Health Equity accounts during the year?

Most of the time, only if they have a qualifying life event may workers adjust their HSA or FSA contributions throughout the year. Qualifying events include, for instance, marriage, divorce, childbirth or adoption, changes in job status, and substantial changes in health insurance. Otherwise, contribution levels are often decided upon during open enrollment and stay the same throughout the plan year.

Q4. How are Wage Works Health Equity accounts impacted by job changes or leaving an employer?

If an employee changes jobs or leaves an employer, their Wage Works Health Equity accounts generally remain with them. HSAs, in particular, are portable and owned by the employee, allowing them to continue using the funds for qualified medical expenses even after leaving the employer. FSAs may have different rules regarding portability, rollover, or use-it-or-lose-it policies, depending on the employer’s plan design.

Q5. Are Wage Works Health Equity benefits subject to taxation?

Usually done with pre-tax monies, contributions to HSAs and FSAs under Wage Works Health Equity programs are free from Medicare, Social Security, and federal income taxes. For particular tax ramifications pertaining to these accounts, workers should, however, speak with a tax professional or examine IRS rules.

Q6. How can employees access their Wage Works Health Equity account information?

Employees can access their Wage Works Health Equity account information through online portals or mobile apps provided by Wage Works or their employer. These platforms allow employees to view account balances, transaction history, submit claims, and manage their contributions conveniently.