Table of Contents

ToggleThe Ultimate Guide to Understanding Health Savings Accounts

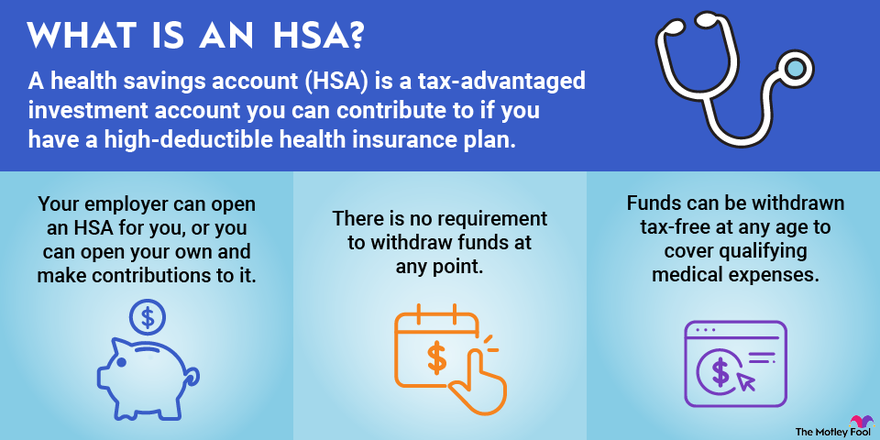

What is a Health Savings Account?

A Health Savings Account (HSA) is a valuable tool for managing healthcare expenses. If you’re looking to save on medical costs and plan for future healthcare needs, an HSA might be just what you need. The workings, advantages, and ways to maximize health savings accounts will be covered in detail in this article.

How Does a Health Savings Account Work?

High-deductible health plan (HDHP) holders may open tax-advantaged savings accounts called HSAs. Here’s how it functions:

- Eligibility: To open an HSA, you must be enrolled in a qualified HDHP. This type of health insurance plan typically has lower premiums but higher deductibles than traditional plans.

- Contributions: You can contribute to your HSA up to the annual limit the IRS sets. You, your employer, or anyone else on your behalf can contribute.

- Tax Advantages: Your HSA allows you to deduct contributions, and withdrawals for approved medical costs are tax-free. The profits from investments or interest also increase tax-free.

- Qualified Expenses: Dr. appointments, prescription drugs, dental care, and other medical costs may all be paid using the money in your HSA.

Benefits of a Health Savings Account

Tax Savings

One of the most significant advantages of an HSA is the triple tax benefit:

- Tax-Deductible Contributions: Reduce your taxable income by contributing to your HSA.

- Tax-Free Growth: Earn interest or investment returns on your HSA balance without paying taxes.

- Tax-Free Withdrawals: Use your HSA funds for qualified medical expenses without incurring taxes.

Flexibility and Control

With an HSA, you have complete control over your healthcare spending. You decide how much to contribute, when to use the funds, and how to invest the balance. Additionally, the funds in your HSA roll over year after year, so there’s no rush to spend the money before the end of the year.

Long-Term Savings

HSAs can be a powerful tool for long-term savings. If you don’t need to use the funds for current medical expenses, you can let your HSA balance grow over time. In retirement, you can use HSA funds for non-medical expenses without penalty, though you will pay income tax on those withdrawals.

How to Maximize Your Health Savings Account

Choose the Right HDHP

Selecting the right high-deductible health plan is crucial for maximizing your HSA benefits. Look for a plan that offers the coverage you need at a premium you can afford while also qualifying for HSA contributions.

Maximize Contributions

Contributing the maximum the IRS allows each year can help you build a substantial HSA balance over time. For 2024, the contribution limits are $3,650 for individuals and $7,300 for families, with an additional $1,000 catch-up contribution allowed for those aged 55 and older.

Invest Your HSA Funds

Mutual funds, equities,, and bonds are among the investing choices available via many HSAs. More quickly than in a regular savings account, investing your HSA money may increase your balance. Your HSA investment should depend on your investing objectives and risk tolerance.

FAQs: About Health Savings Account

What Can I Use My HSA For?

You can use your HSA funds for a wide range of qualified medical expenses, including:

- Doctor visits

- Prescription medications

- Dental and vision care

- Medical equipment and supplies

- Over-the-counter medications (with a prescription)

What Happens to My HSA If I Change Jobs?

No matter where you work or what health insurance plan you choose, your HSA stays with you. You can keep using the money for approved medical costs, and you can keep making HSA contributions even if you move to a different HDHP.

Are There Penalties for Using HSA Funds for Non-Medical Expenses?

Before you are 65 years old, you will be assessed a 20% penalty and income taxes on the amount of your HSA withdrawal. The money is free to utilize for non-medical purposes beyond 65, but income taxes will still be due on any withdrawals.