Table of Contents

ToggleChoosing the Right Health Insurance Plans

Finding the correct coverage to suit your needs can be difficult when navigating the world of health insurance plans, but it is vital. Health insurance programs shield you from the high cost of medical treatment by guaranteeing that you may get the care you require without going broke. This tutorial will cover the many kinds of health insurance policies, their advantages, and how to pick the best one for your family.

Understanding Health Insurance Plans

Plans for health insurance are contracts that you sign with an insurance provider, which pays a percentage of your medical bills in return for a premium. The primary goal of these plans is to protect you from high healthcare costs. Here’s a closer look at the different types of health insurance plans available:

Types of Health Insurance Plans

- Health Maintenance Organization (HMO) Plans

- Mandates that participants select a primary care physician (PCP)

- Must get referrals from the PCP to see specialists

- Restricted to a network of medical professionals and institutions

- Preferred Provider Organization (PPO) Plans

- More flexibility in choosing healthcare providers

- No need for referrals to see specialists

- Higher out-of-pocket costs for out-of-network care

- Exclusive Provider Organization (EPO) Plans

- Combines features of HMOs and PPOs

- There is no need for referrals, but it is limited to a network of providers

- No coverage for out-of-network care

- Point of Service (POS) Plans

- Needs referrals to specialists and a primary care physician

- Allows out-of-network care at higher out-of-pocket costs

- Flexibility in choosing providers

- High-Deductible Health Plans (HDHPs)

- Lower premiums with higher deductibles

- Often paired with Health Savings Accounts (HSAs),

- Suitable for those who rarely need medical care

- Catastrophic Health Insurance

- Designed for young, healthy individuals

- Low premiums with very high deductibles

- covers necessary medical benefits upon payment of the deductible.

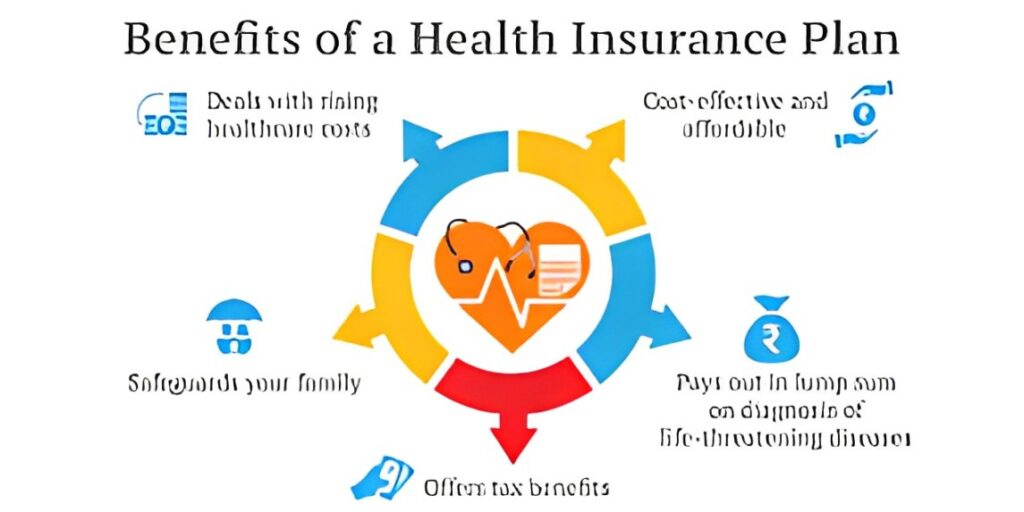

Benefits of Health Insurance Plans

Plans for health insurance have several advantages that make them a crucial component of your financial strategy. Here are some key advantages:

Financial Protection

Health insurance plans protect you from excessive medical costs. Without insurance, a single hospital visit or procedure can lead to significant financial strain. Insurance plans cover a large portion of these expenses, reducing your out-of-pocket costs.

Access to Preventive Care

Preventive care includes annual physicals, screenings, and vaccines and is often covered at no extra cost by health insurance policies. This access to preventive care helps detect health issues early and manage them effectively.

Comprehensive Coverage

Health insurance plans provide comprehensive coverage, including hospitalization, emergency services, prescription drugs, and maternity care. This ensures that you receive the necessary medical attention without worrying about the costs.

Peace of Mind

If you have health insurance, you can feel secure in the knowledge that you are covered in the event of an urgent medical circumstance. With this protection, you may stop worrying about future financial difficulties and instead concentrate on your health and well-being.

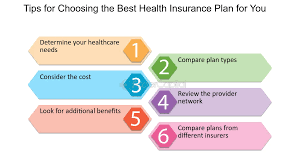

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan involves evaluating your healthcare needs, budget, and preferences. To assist you in reaching a well-informed conclusion, follow these steps:

Assess Your Healthcare Needs

Consider your medical history, the frequency of doctor visits, and any ongoing health conditions. If you have a chronic condition or require regular medical care, a plan with comprehensive coverage and lower out-of-pocket costs may be ideal.

Compare Plan Types

Examine the many kinds of health insurance policies that are offered. An HMO or POS plan can be appropriate if you would rather have a primary care provider and referrals. If you want more flexibility in choosing providers, consider a PPO or EPO plan.

Review Costs

Examine the premiums, deductibles, copayments, and out-of-pocket maximums of each plan. Make sure the plan you choose is within your budget and provides adequate coverage. Remember that lower premiums often come with higher out-of-pocket costs and vice versa.

Check Network Providers

Make sure the network of the health insurance plan covers the physicians, hospitals, and healthcare facilities that you have a preference for. If you have existing relationships with certain healthcare providers, verify their inclusion in the plan’s network.

Consider Additional Benefits

Certain health insurance plans offer extra benefits like wellness programs, telemedicine services, and gym membership discounts. These extra features can improve your entire experience of receiving healthcare.

FAQs About Health Insurance Plans

Q: What distinguishes PPO and HMO plans from one another?

A: PPO plans give members more freedom in selecting healthcare providers and do not require recommendations; in contrast, HMO plans require participants to choose a primary care physician and secure referrals for visits with specialists. Compared to HMOs, PPO plans usually have higher premiums and out-of-pocket expenses for care received outside of the network.

Q: How do high-deductible health plans (HDHPs) work?

A: HDHPs have greater deductibles than premiums, which means you must spend more out of pocket before the insurance begins to pay for expenses. They are frequently used in conjunction with Health Savings Accounts (HSAs), which let you save aside money for medical costs tax-free.

Q: Can I use my health insurance plan outside of the network?

A: It depends on the type of plan. HMO and EPO plans generally do not cover out-of-network care except in emergencies. PPO and POS plans allow out-of-network care but at higher out-of-pocket costs.

Q: A Health Savings Account (HSA): What is it?

A: Anybody enrolled in a high-deductible health plan (HDHP) is eligible to open a tax-advantaged savings account or HSA. You can use the funds in your HSA to pay for qualified medical expenses, and contributions are tax-deductible.

Q: How do I know if I qualify for catastrophic health insurance?

A: Those under 30 or those who meet the requirements for a hardship exemption can obtain catastrophic health insurance. It offers low premiums with very high deductibles and is designed to cover worst-case scenarios.